How To Spot Early Signals Of Stock Market Bubbles

Stock market bubbles can be difficult to detect in their early stages, yet recognizing the signs early enough can help investors protect their capital and avoid major losses. A stock market bubble occurs when the prices of stocks, assets, or commodities become inflated far beyond their intrinsic value, often driven by irrational investor behaviour and excessive speculation. By learning to spot these early warning signs, investors can make more informed decisions and reduce the risk of falling victim to a market collapse.

What Are Stock Market Bubbles

A stock market bubble typically forms when the price of an asset rises rapidly and unsustainably, often due to excessive optimism, speculation, and market hysteria. During a bubble, investors start to buy assets not based on their fundamental value but because they believe that prices will continue to rise indefinitely. This creates a cycle of rising demand and prices, which attracts more buyers, pushing the prices even higher.

The formation of a bubble is often followed by a sharp decline when reality catches up with the inflated prices. The market then crashes, leading to significant losses for those who bought into the bubble at its peak.

Recognizing Overvaluation

One of the key signals of a stock market bubble is overvaluation. When asset prices begin to diverge significantly from their fundamental values, a bubble could be forming. Overvaluation occurs when stocks are priced far above what their underlying financial metrics would justify. For example, suppose a company is trading at a price-to-earnings (P/E) ratio that is historically high compared to its earnings growth potential. In that case, it might indicate that the market is overestimating the company's future profitability.

This overvaluation can be observed in several ways. One of the most common indicators is a surge in stock prices without a corresponding increase in the company’s earnings or revenue. If investors are willing to pay exorbitant prices for stocks with little regard for the company’s financial health, it could signal that a bubble is forming.

Excessive Media And Public Hype

During a bubble, the media often becomes filled with stories of stocks or sectors experiencing rapid growth. This media coverage can fuel investor enthusiasm, leading to a herd mentality where people rush to buy stocks out of fear of missing out (FOMO). When a particular stock or asset class becomes the subject of intense media coverage, it’s often a sign that the bubble is nearing its peak.

The spread of media hype can also lead to a situation where individuals with little to no experience in the stock market start investing in certain assets, further driving up prices. This phenomenon is often referred to as "retail investor frenzy." When people are talking about a stock or sector in every social gathering, it's essential to be cautious, as this kind of behaviour is frequently seen before a bubble bursts.

Unprecedented Price Movements

Another clear indicator of a potential stock market bubble is the occurrence of rapid, often erratic, price movements. In a healthy market, asset prices tend to rise gradually based on the underlying economic conditions, such as corporate earnings growth or improvements in economic indicators. However, in a bubble, prices can increase dramatically in a short period, often without any solid economic backing.

These price surges can happen in specific sectors or across the broader market. For instance, during the dot-com bubble of the late 1990s, the tech sector experienced rapid growth driven largely by speculation rather than real, sustainable business growth. Similarly, during the housing bubble that led to the 2008 financial crisis, home prices in certain markets saw extreme rises, driven by speculative real estate investments rather than actual demand for housing.

Rising Volatility

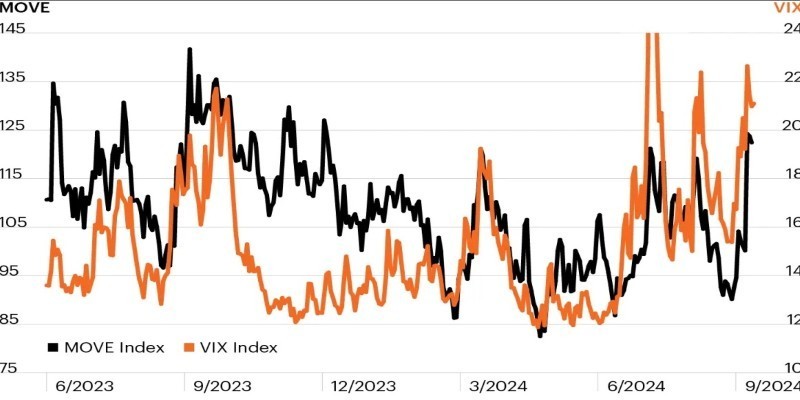

Stock market bubbles are often accompanied by increased volatility. As asset prices soar, the market becomes more susceptible to sudden swings, as investors become more sensitive to any news or events that might threaten the continued rise in prices. In a bubble, volatility is typically characterized by large, rapid fluctuations in asset prices, with no clear connection to the underlying economic fundamentals.

Rising volatility can indicate that the market is becoming increasingly unstable and that investors are becoming more uncertain about the future direction of prices. This is often a precursor to a market correction or crash as the bubble begins to deflate.

Speculation And The "Greater Fool" Theory

Speculation is another important indicator of a stock market bubble. The "greater fool theory" suggests that individuals invest in overvalued assets because they believe they can sell them at an even higher price to a "greater fool"—someone who will pay more for the asset without considering its true value. This speculative behaviour can create a feedback loop of rising prices, as people buy assets not for their inherent value but because they believe they can sell them to someone else for a higher price.

During a bubble, speculative activity often becomes rampant, with investors placing increasingly risky bets in the hopes of capitalizing on the market's upward momentum. However, once the market starts to turn, the speculative frenzy can quickly collapse, leading to significant losses for those left holding overvalued assets.

Lack Of Fundamental Support

In any healthy market, asset prices are ultimately supported by the underlying fundamentals—such as a company's earnings, the economic outlook, and other financial indicators. However, during a stock market bubble, these fundamentals often take a backseat to speculative forces. Investors may ignore traditional valuation metrics, such as price-to-earnings ratios or price-to-book ratios, in favour of chasing quick profits.

When this happens, it can create a disconnect between the price of an asset and its true value. This lack of fundamental support makes the market more vulnerable to sudden corrections as investors eventually begin to realize that the high prices are not sustainable.

Conclusion

Spotting early signals of a stock market bubble can be challenging, but by paying attention to certain key indicators, investors can better protect themselves from the risks of market overvaluation. Overvaluation, excessive media hype, rapid price movements, and increasing volatility are all signs that a market bubble could be forming. Additionally, increased margin debt, speculative behaviour, and a lack of fundamental support can signal that asset prices are no longer sustainable.